National scientific conference: Stimulating the economy, increasing the velocity of cash flow

24 May, 2021

(ĐTTCO) - To support the economy against the Covid-19 pandemic, a large amount of money has been poured into the cash flow by the Government. However, money has shown signs of being blocked in the financial system while being poured into stocks and real estate investment channels rather than production. This situation requires more drastic solutions to bring cash flow into the production sector.

The slow velocity of cash flow

In need of restoring the economy after the Covid-19 pandemic, the Government has been implementing a combination of expanded monetary and fiscal policies to promote GDP growth. In 2019 and 2020, the State Bank lowered the operating interest rates three times to implement the monetary expansion policy and stimulate the economy. Will this be enough to create a force for Vietnam's economic "chariot"? Besides the concept of money supply, it is also essential to pay attention to the velocity of cash flow - another measure of the health of the economy.

According to Milton Friedman's quantity theory of money: M*V = P*Q, where M stands for the money supply, V stands for velocity of money, and P measures the change of prices of goods and services produced in In an economy, Q stands for the quantity of goods and services traded. The velocity of money is related to the frequency of monetary transactions in the economy. High money velocity is often a sign of a healthy economy, as money is given to trade goods quickly, and the rotation of money can take place faster.

Economists divide money into two categories: money mainly used by people and companies for transactions called “working money”; money used to save up and accumulate is called “idle money”. The more idle money there is in the economy, the slower the money moves.

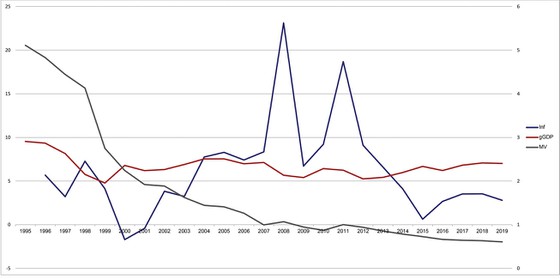

The relationship between inflation, GDP growth and the velocity of money (source: Author's compilation)

The relationship between inflation, GDP growth and the velocity of money (source: Author's compilation).

The graph shows that the velocity of money in Vietnam has continuously dropped to a very low level in the past 20 years. But is the current low velocity of money due to too much idle money in the economy? The decreasing velocity of money in Vietnam implies that the flow of money from one person to another is very slow, reflecting a decline in transactions and consumption by businesses and households after 2011.

Instead, most of the money could have been used to pour into investment channels such as securities, real estate or exist in the form of savings rather than in the production and consumption sector. This cash flow may be the source for the "bubble" of real estate and securities in recent times.

Since the outbreak of the Covid-19 epidemic until the end of 2020, 95 documents have been issued to support businesses and people with 4 major policy packages: VND 250,000 billion in supporting credit, VND 180,000 billion in supporting tax payment deferral, VND 16,000 billion in loaning with 0% interest, VND 30,000 billion fiscal package and a series of other measures. This was followed by a social security support package of VND 62,000 billion according to Resolution 42/NQ-CP on measures to support people facing difficulties due to the Covid-19 pandemic.

But the velocity of money continued to decline during this period, showing that the huge amount of money seemed to have been trapped in the public financial system with the consumer's reluctance to consume, causing GDP growth not to be as high as the expected level. The disbursement conditions for manufacturing and service enterprises were quite strict, the social security system could be considered as outmoded, which also made the effectiveness of the support policy significantly reduced.

Solutions to stimulate growth

Firstly, increase the velocity of money. In order to increase the velocity of money, it is necessary to promote the expenditure on goods and services, the faster a unit of money is used to spend, the greater the demand for goods and services, stimulating production, increasing employment, income growth and ultimately GDP growth. In society, people with low incomes are often the fastest to spend money on goods and services whenever they have money in hand.

Therefore, the Government needs to drastically reform social security policies so that the support money can be quickly delivered to the people, especially the disadvantaged and low-income groups. When they have more money, they will use more services, which will increase purchasing power, stimulate the production process, create more jobs, higher salary and in turn will create circulation to promote economic development.

Secondly, promote credit growth. The manufacturing sector is an important driver of economic growth. Therefore, the Government needs to have solutions to facilitate credit flows to businesses and households. In addition, tightening capital flows into real estate speculation or investing in stocks to avoid deviations of investment cash flows, causing asset bubbles that are not conducive to economic and socio-economic development.

Banks can lower profit targets and share them with manufacturing enterprises and households with medium-term loan packages with attractive and stable interest rates, helping them stabilize production. When production enterprises are stable, workers will have more jobs, and there will be a fertile ground for banks to exploit to make a profit.

Thirdly, promote the digital transformation of enterprises and state management agencies. Invest in digital transformation today to create momentum for future economic growth, save costs and improve operational efficiency. The digital transformation process will help businesses increase productivity, boost output growth commensurate with the increase in money supply, and help keep inflation at a stable level.

Digital transformation can be the key to helping enterprises' production processes rise to a new level, creating a turning point for the economy, helping the economy to take off from stagnant traction and gradually enter into the process of stable growth, which does not need too much fiscal and monetary stimulus from the Government.

Promoting the circulation of money, opening credit and accelerating digital transformation are urgent requirements to increase output and stimulate post-Covid-19 economic growth.

Author: Quách Doanh Nghiệp.

Source: Sài Gòn Đầu tư Newspaper.

.jpg)

![[Research Contribution] Sustainable Manufacturing: A Driving Force for the Green Economy and the Challenges Ahead](/images/upload/thumbnail/ueh-thumbnail-639082294182922007.png)

![[Research Contribution] The influence of greenwashing on green purchasing intentions in the electric motorbike sector: the mediating role of green brand trust and green word-of-mouth of GenZ](/images/upload/thumbnail/ueh-thumbnail-639081264718342243.png)